With the government looking set to abolish the current Provisional Gasoline Tax of 25.1 yen/ litre, it’s a good time to delve into the breakdown of what we actually pay to fill our tanks and where it goes.

First, let’s get to know this apparently soon to be banished Provisional Gasoline Tax because it’s a doozy, being as provisional is a synonym for temporary.

Back in 1949, with the rebuilding of the country and its road transport infrastructure, the base Gasoline Tax of 28.7 yen/ litre we still have today was instigated. Come 1974, the road networks were falling behind demand and the funding the original base Gasoline Tax provided wasn’t keeping up leaving the country in dire need of efficient vehicle transport infrastructure to compliment the rapidly expanding and modernising industry fueling the ballooning economy. So, a specific tax, termed Provisional Gasoline Tax, was added to gasoline with the funds generated going directly into the vehicle transport infrastructure. This was locked in at 25.1 yen/ litre in 1979 and stayed that way into the next century.

Fast forward three decades to 2010 and that Provisional Gasoline Tax was abolished and replaced with another Provisional Gasoline Tax of the identical amount but without the restriction of being solely used for vehicle transport infrastructure. Actually, none of it needed to be used for the roads and their supporting infrastructure. It became a general coffers tax. Boo! Thankfully, that’s the one supposedly being abolished.

But while we are here, how about a round of applause for the Provisional Gasoline Tax which turned 50 this year. 👏 🎉 So very provisional. 😄

Now, let’s take a look at ALL the taxes we pour into our tanks.

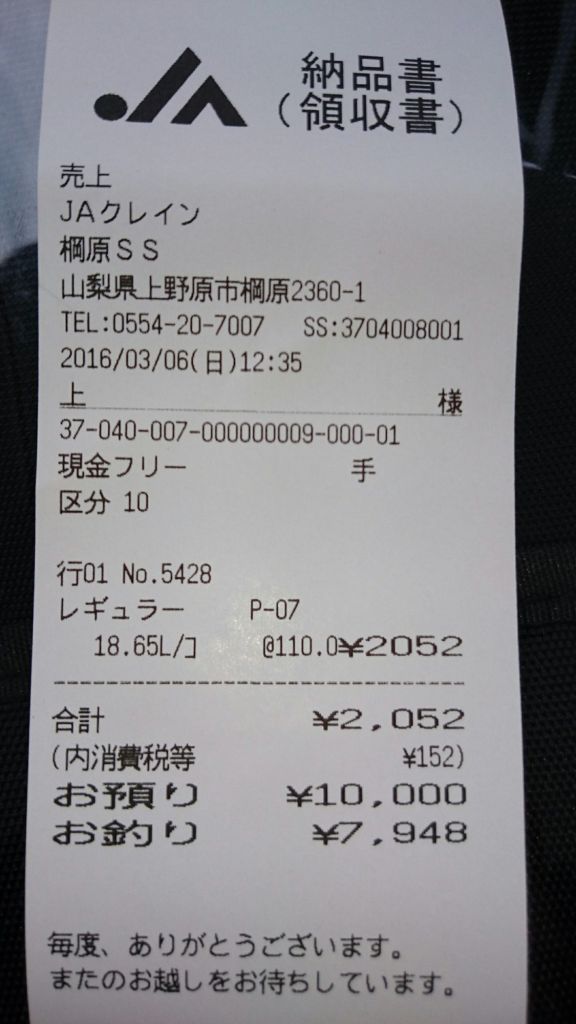

We have Petroleum and Coal tax 2.04 yen/litre + Global Warming Countermeasures Tax 0.75 yen/litre + base Gasoline Tax 28.7 yen/litre + Provisional Gasoline Tax 25.1 yen/litre and then take all of those plus the cost of the gasoline itself and multiply their total by 1.1 to include the 10% Consumption Tax.

Oddly, we have a tax on tax calculation… Bit dodgy that one. Especially for a government.

Another oddity, not of the dodgy but of the muddying the waters variety, is the ‘Oil Price Sudden Fluctuation Mitigation Subsidy’ of 14.9 yen/litre, established in 2022 to counter the economic difficulties post-covid. It’s here to help but set to soon fall by 5 yen/litre and in further periodic increments until eliminated.

So, we have a 25.1 yen/litre drop, yet a 14.9 yen/litre increase. Hmm. It is a positive but it sure does shrivel that big fat ‘Provisional Gasoline Tax Abolishment Imminent’ headline. Oh, did I mention that there’s no set schedule for that either. Yes, it’s just a general agreement between the major parties of parliament and likely has a lot of kicking around as a political football before being able to be abolished.

At the end of the current day though, in taxes per litre and subsidies alone we currently have an additional 56.69 yen in taxes, before the total consumption tax which would bring it up to around 70 yen/litre currently depending on fuel grade, minus a 14.9 yen subsidy. On a cheap gas day that could be near on a 1/3 the cost of filling your tank.

So, next time you’re standing there filling your tank, watching the litres turn over on the bowser meter, try to listen for the 50 yen coins falling.

Article current as of December 14, 2024

Modern government’s have been using specific taxes to support that area of taxation since dirt. IE: Tabaco and alcohol/Heath care. As you mentioned Gas/ road infrastructure… but hey they’re modern.. 😉

LikeLike